Rule Book for Commercial Real Estate Investment

Are you looking to channelize your money in a commercial property? If yes, it is necessary to keep in mind that investing in commercial real estate is quite different from putting money into a residential property. By making a sound investment, you can expect to yield higher returns in comparison to most debt instruments.

Whether you’re a NRI looking to invest in an upcoming commercial property or an investor looking to yield higher ROI out of your investment, taking the right decision is very crucial right from the beginning.

To make it easier for you making commercial real estate investment, here are some crucial factors that need to be looked into. Let’s explore them below.

1. Location is everything

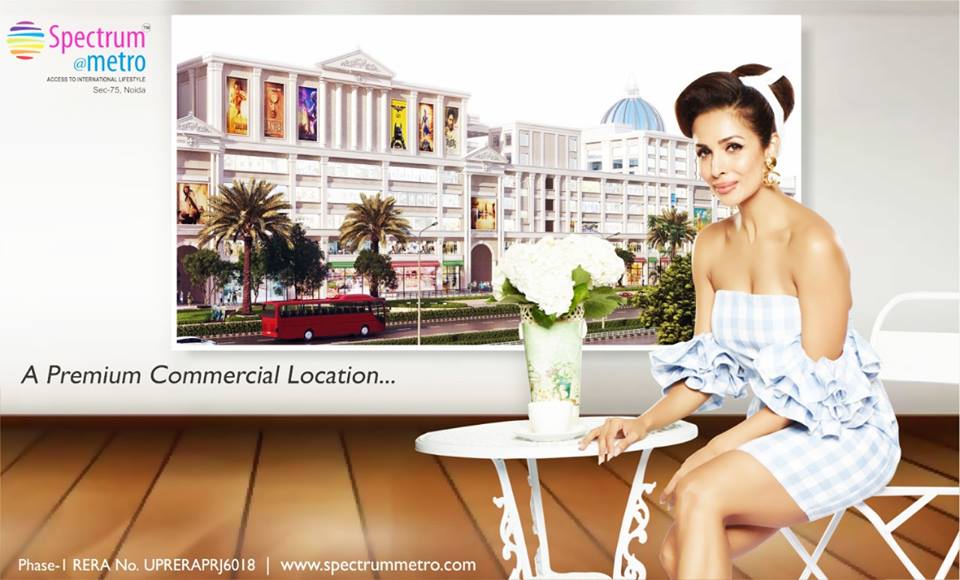

Commercial properties are meant to deliver returns through two channels— rent and capital appreciation. Both of them depend heavily on the location aspect. Browse through locations where vacancy is less than 5%. This simply means that supply is proper and tenants are less expected to vacate, ensuring better rents and capital appreciation. Always look for locations that have been experiencing fast infrastructure development. For example, there are various locations in Noida and Gurgaon that have been witnessing tremendous infrastructure development nowadays.

2. Act like a professional

For all investors searching for commercial real estate opportunities in Delhi-NCR, there are seasoned experts who are fluent in the field of the business. When you start approaching like these investors, you immensely increase your likelihood of commercial real estate success. The better conversant you are the easier it becomes to make more constructive and worthy decisions. Here are a few key points you should know if you are seeing this property:

• It is necessary to keep in mind that the value of a commercial real estate property is directly associated with the usable square footage that is ready for use within the space. This is not necessarily evident in residential real estate. Considering this, it becomes clear that multi-family dwellings such as apartment buildings or multi-unit retail spaces are set togive a higherROI on your primary investment.

• The extent of a lease will majorlyinfluence your cash flow as an investor. Commercial property leases are generally quite a bit lengthyas compared to residential leases, including another bonus to this type of investing.

• Always figure out what is expected from you from a cash stance. Commercial real estate investors are generally expected to attract a down payment of a minimum of 30% to the table.

• Keep a sharp eye! When looking for available properties, don’t forget to focus on damages that might need either instant repairs or costly repairs down the line. This can help you through the negotiation process or perhaps, even to avert making a primary investment in the first place.

3. Discover your options and decide on your budget

It is quite clear, especially when the market is flooded with a lot of commercial real estate investment opportunities. Commercial real estate is not restricted solely to retail or office space, but also encompasses apartments, warehouses, healthcare buildings, hotels, countryside, and industrial space, to name a few. Once you have decided which investment is ideal for you, decide on a viable budget and remain stick to it. For each property you gaze at, take into account your budget and your net operating income. This refers to all of the revenue and costs linked with a specific property.

In recent times, several commercial properties have emerged out in the NOIDA region that makes the promise of amazing returns in near future. Some of the leading ones are spectrum@metro. Before putting your hard-earned money in any of them, do pay consideration to all of the above points and cultivate great returns in future.

Category

Recent Post

Archives

- January 2024

- October 2023

- September 2023

- August 2023

- May 2023

- April 2023

- February 2023

- January 2023

- December 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- November 2020

- September 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- October 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- November 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

Tag

- Best Commercial Property in Noida

- buy office space in 75 noida

- buy office space in noida

- buy serviced apartments in Noida

- commercial development in sector 75 noida

- Commercial Office Space

- Commercial Office Space in Noida

- commercial property

- Commercial property in noida

- commercial shop in Noida

- Commercial Space

- commercial space in noida

- corporate center

- GST

- GST 2017

- GST impact on Indian real estate

- Impact on Commercial Real Estate

- Noida Builder

- Office Space

- office space at Spectrum@Metro sector 75

- Office Spaces in Noida

- Office Spaces in Sector 75 Noida

- property in noida

- property in sector 75 noida

- Real Estate Regulatory Act

- Real Estate Regulatory Authority

- RERA

- RERA Bill

- RERA impact on real estate industry

- retail shop

- Retail shops in noida

- Retail Spaces

- Retail spaces in Noida

- serviced apartments

- serviced apartments in noida

- serviced apartments in sector 75 Noida

- Small Investments with Big Rentals

- Spectrum Metro

- Spectrum Metro Noida

- Spectrum Metro office space

- Spectrum metro serviced apartments

- Spectrum Metro serviced apartments Noida

- Spectrum Metro serviced apartments sector 75

- Spectrum Metro virtual spaces

- Spectrum@Metro

- virtual spaces in Noida

- virtual spaces in Sector 75 Noida

Our Partners

Spectrum Metro I: Phase-1 RERA Regd. No.: UPRERAPRJ6018, Phase-2 RERA Regd. No.: UPRERAPRJ6028, Phase-3 RERA Regd. No.: UPRERAPRJ6037, Phase-4 RERA Regd. No.: UPRERAPRJ6040

Spectrum Metro II: Project RERA Regd. No. Block (B, C & D) : UPRERAPRJ17035, Block (A & E): UPRERAPRJ427696 RERA Website: www.up-rera.in | 1 Sq.mtr. = 10.764 Sq.ft. Disclosure: All specifications, designs, layout, images, conditions are only indicative and some of these can be changed as per the discretion of the builder/architect/authority. These are purely conceptual and constitute no legal offerings. *T&C Apply

© Copyright 2023, all rights reserved with Spectrum @ Metro | Design Developed By: Cross Section